Introduction to Fractal Analytics and Its Importance

Fractal Analytics, a leader in AI-driven analytics and decision-making solutions, is gearing up for its highly anticipated initial public offering (IPO). With its innovative approach that blends AI technology with analytical insights, Fractal is positioned to make a significant impact in the analytics industry.

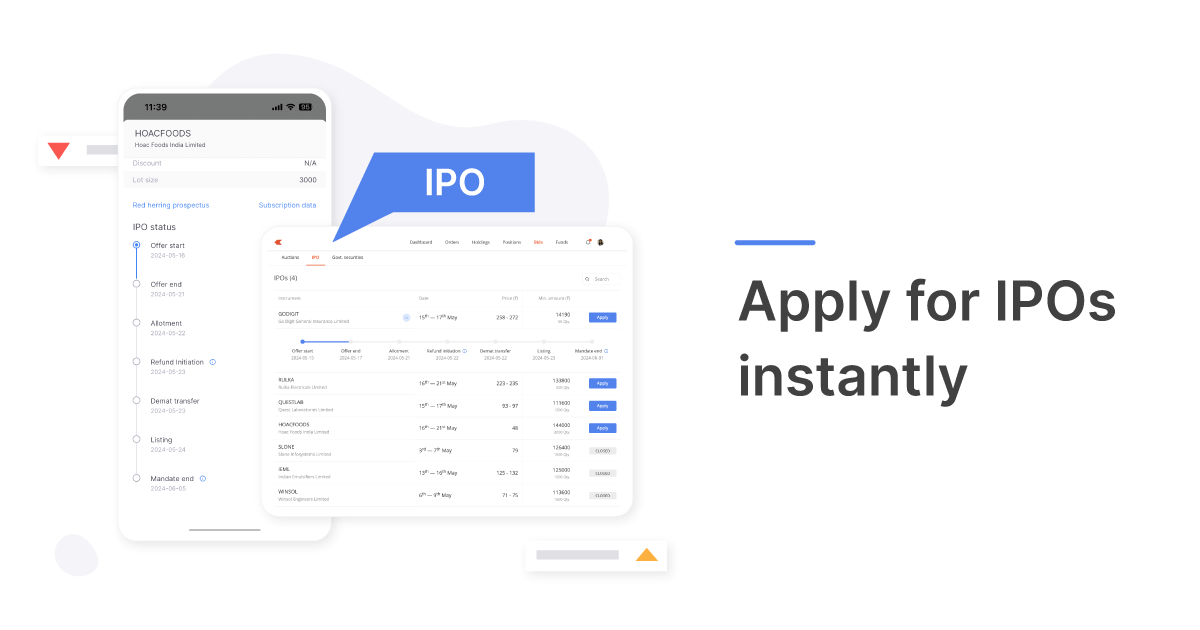

Details of the IPO

The IPO, scheduled for early next year, aims to raise approximately $500 million, which will be used to fuel the company’s expansion efforts and technological advancements. Investors are optimistic due to Fractal’s robust year-on-year growth, reporting an increase in revenue by over 30% in the last fiscal year. The company’s clientele includes Fortune 500 companies, demonstrating the demand for its services.

Market Relevance and Trends

The timing of this IPO is particularly relevant, as more and more enterprises are turning to data analytics to drive their decision-making processes. The global market for data analytics is forecasted to reach $300 billion by 2026, with AI-driven solutions becoming a substantial part of that growth. Fractal’s innovations in predictive analytics and machine learning place the company in an advantageous position to capitalize on this market trend.

Conclusion and Future Outlook

The upcoming Fractal Analytics IPO is anticipated to generate significant interest among investors given the company’s strong growth trajectory and the expanding analytics market. If successful, this IPO could not only enhance Fractal’s market presence but also provide extensive returns for investors, setting a precedent for future tech IPOs in the analytics space. As the demand for data analytics solutions rises, Fractal Analytics is poised to play a crucial role in shaping the future of decision-making technologies.