Introduction to CPI Inflation Rate

The Consumer Price Index (CPI) inflation rate is a crucial economic indicator that measures the average change over time in the prices paid by consumers for a basket of goods and services. Understanding the CPI inflation rate is vital not only for policymakers but also for businesses and consumers as it affects purchasing power and influences economic stability.

Current Trends in CPI Inflation Rate

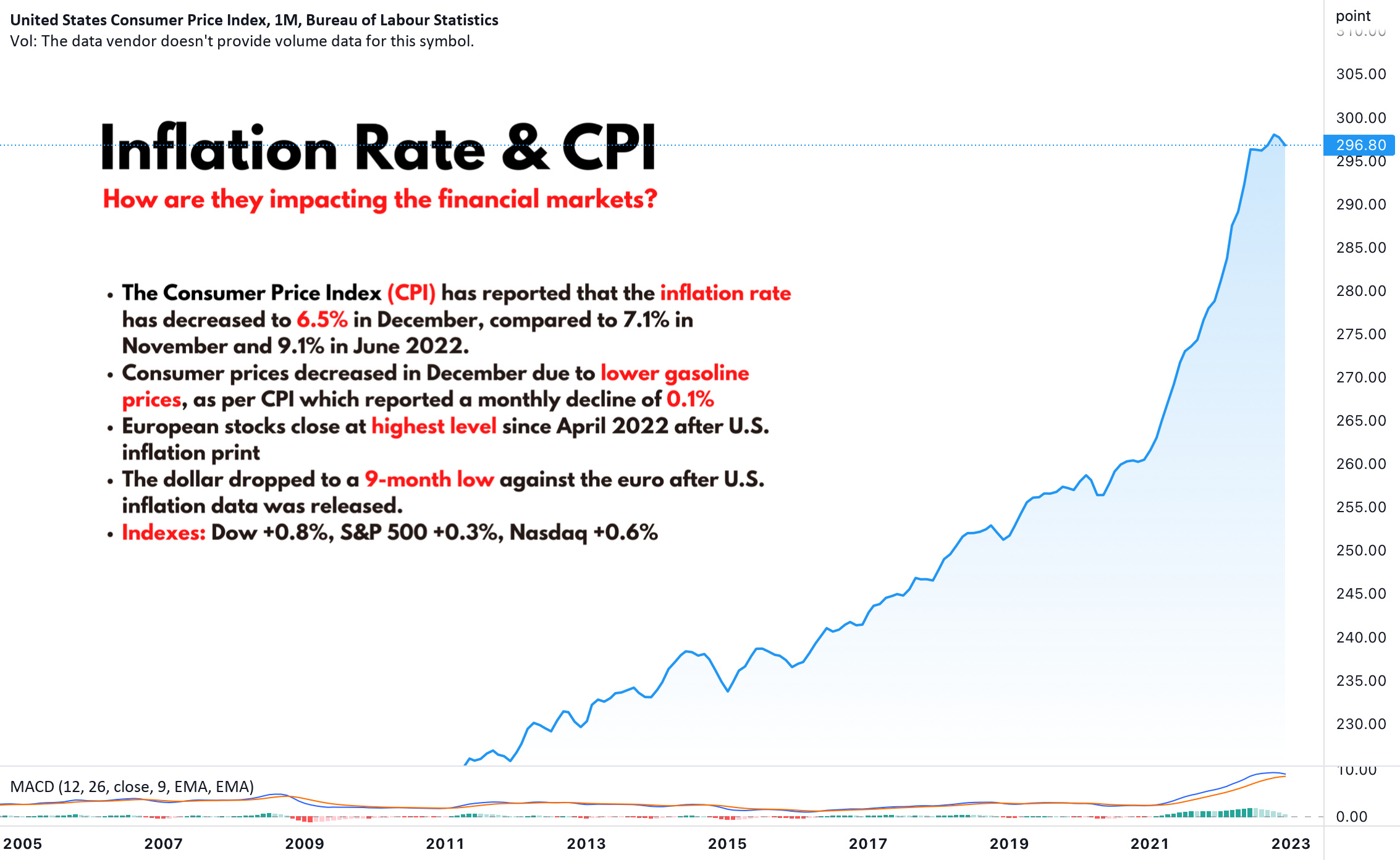

As of October 2023, the CPI inflation rate in the United States has shown significant fluctuations driven by a variety of factors including supply chain disruptions, energy prices, and changing consumer demands. According to the Bureau of Labor Statistics (BLS), the CPI increased by 3.7% year-over-year in September, which marks a slight decrease from previous months where inflation rates reached peaks of over 9%. This decline is welcomed by consumers and policymakers alike, as it suggests a potential easing of inflationary pressures in the economy.

Factors Influencing Current Inflation

Several factors have impacted the current CPI inflation rate. One primary factor is the Federal Reserve’s monetary policy aimed at curbing inflation through interest rate hikes. Over the past year, the Federal Reserve has raised interest rates multiple times, which aims to slow down spending and borrowing and, consequently, reduce inflation. Additionally, the ongoing stabilization of supply chains post-pandemic has contributed to a decrease in various goods’ prices, further reducing the overall CPI.

Impacts of CPI Inflation on the Economy

The CPI inflation rate is not just a number; it has tangible effects on the economy and people’s lives. High inflation rates erode purchasing power, meaning that consumers cannot buy as much with the same amount of money. This can lead to decreased consumer confidence and spending, ultimately affecting business revenues and economic growth. Conversely, a lowered or stabilized CPI inflation rate can enhance consumer confidence, prompting increased spending and investment—which is crucial for economic recovery.

Conclusion: The Path Ahead

As we move closer to the end of 2023, analysts and economists will continue to monitor the CPI inflation rate closely. Many predict that as supply chains continue to normalize and the effects of monetary policy manifest in the economy, we might see the CPI inflation rate stabilize further. However, unexpected global events or changes in energy prices could still play a significant role in future inflation costs. For consumers and businesses alike, staying informed about these trends is essential for financial planning and decision-making.