Introduction

Union Bank is a significant player in the financial services sector, offering a range of banking products and services to individuals and businesses. With its focus on customer satisfaction and adaptation to technological advancements, Union Bank plays a crucial role in facilitating economic growth and financial stability. As the banking landscape evolves, the importance of understanding Union Bank’s operations and recent developments is more prominent than ever.

Recent Developments

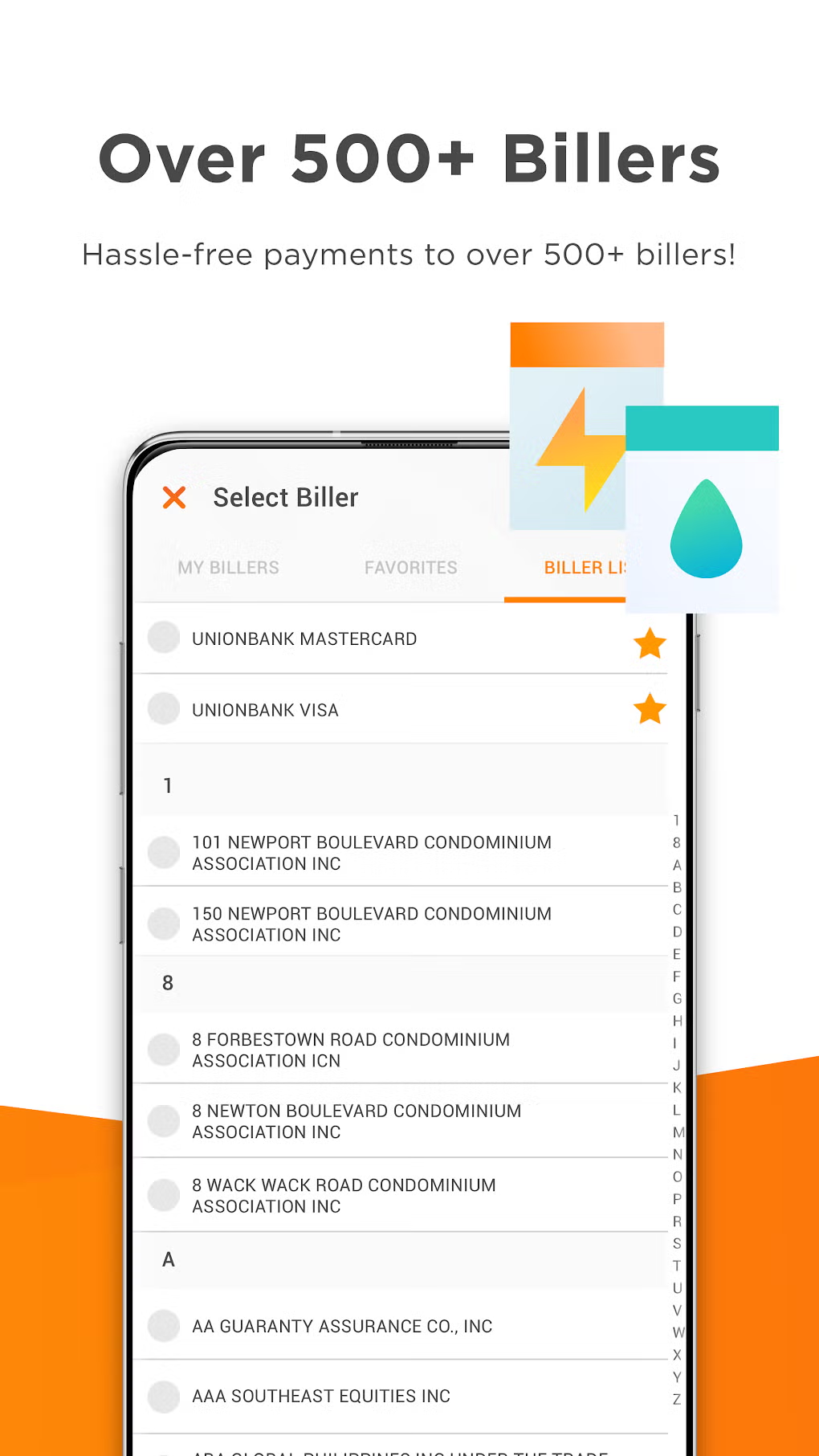

In recent months, Union Bank has announced several initiatives aimed at enhancing its digital banking capabilities and customer experience. In July 2023, the bank launched its updated mobile banking app, which includes features such as personalized financial recommendations and enhanced security measures. These advancements are part of a broader trend in the banking industry, where institutions are increasingly relying on technology to meet customer demands.

Additionally, in August 2023, Union Bank reported strong quarterly earnings, demonstrating resilience amid challenging economic conditions. The bank’s net income for the second quarter of 2023 rose by 15% compared to the previous year, driven by growth in loans and strong management of operational expenses.

Community and Social Responsibility

Union Bank has also made headlines for its commitment to community engagement and social responsibility. In September 2023, the bank launched an initiative to provide financial literacy programs to underserved communities. This program aims to equip individuals with the necessary knowledge and skills to make informed financial decisions, fostering greater financial inclusion.

Conclusion

As Union Bank continues to adapt to the changing financial landscape, its recent developments highlight the bank’s commitment to innovation, customer engagement, and social responsibility. The focus on digital banking and community support is essential for maintaining competitiveness in an increasingly digital world. For customers and stakeholders, Union Bank’s proactive approach signifies a promising future, reflecting both resilience and a dedication to enhancing customer experiences while contributing to community well-being.